- Home

- /

- Trending-News

- /

- BVN/NIN linkage: Lagos...

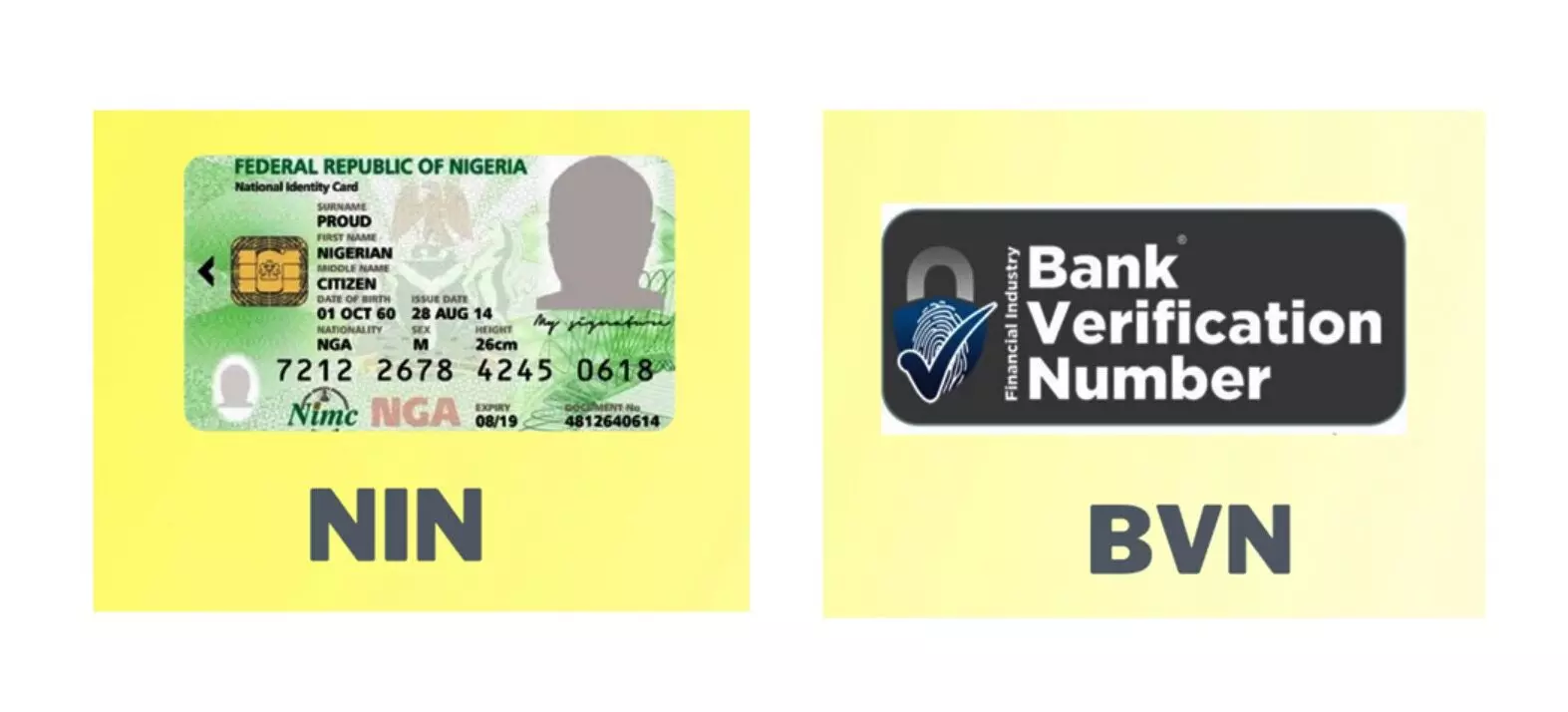

BVN/NIN linkage: Lagos residents besiege banks, seek extension

Bank customers have continued to besiege various bank branches in Lagos to meet the Central Bank of Nigeria (CBN) deadline for linking bank verification numbers (BVN) and national identification numbers (NIN) to their accounts.

In separate interviews with the newsmen, the bank customers also asked the CBN to extend the deadline for them to link their BVN and NIN with their accounts.

Supreme News reports that the deadline was given in a directive issued by CBN in a circular on Dec. 1, 2023, for Tier-1, Tier-2, and Tier-3 accounts to avert being frozen.

The circular was addressed to all commercial, merchant, non-interest and payment services banks, other financial institutions and mobile money operators.

The apex bank said from March 1, defaulting account will not be able to carry out transactions.

The correspondent, who visited some banks on the mainland, observed that there is a sense of urgency and concern among customers due to the deadline for linking NINs to bank accounts.

With the implementation of the directive, which started today, there was a significant gathering of customers at various banks as early as 8 a.m. for the purpose of linking NIN with their bank accounts.

Bank officials, upon resumption, began to answer questions and guide customers on what to do.

Some customers were worried about the security implications of registering online, while others requested an extension of the deadline given the challenges faced during the process.

A security officer at a GTCo branch in Abule Egba, while addressing customers who were eager to gain entrance into the banking hall, said that the message sent out by the bank to its customers concerning the directive was a random one.

He said not all customers who got the message were affected by the directive.

This got the people infuriated, as they said that the bank should have sent out messages to only those affected.

Also, at another GTCO branch in Egbeda, the bank advised customers to register online using specified codes displayed on the walls outside the banking hall.

An official was assigned to assist customers with generating codes and then providing tally numbers for entrance into the banking hall.

Customers numbering about 100 were advised to begin the registration personally by going online to apply codes written and pasted on the walls outside the banking hall.

The notice read, “How to Get the Virtual NIN.

“*346*3*NIN No*292968#.

“Kindly come with NIMC SLIP.”.

After applying the codes, a bank official was stationed outside to copy the codes generated to customers phones after the registration.

Those with the codes were then given tally numbers, which they will use to gain entrance into the banking hall, subject to the availability of spaces inside.

The bank’s security officials supported by regular security operatives manned strategic positions to ensure orderliness.

A trader, Mr. Chukuka Orji, said that he was afraid of his accounts being hacked and therefore preferred to come to the bank, not minding the crowd.

“I don’t mind the crowd, Nigeria is tough these days. I don’t want to apply any code that will wipe out my hard earned money. That is why I came here early today.

“The government should extend this deadline. How can this bank attend to everybody here before 3 p.m. when they said they would close today?” he queried.

However, at Polaris Bank, the crowd was not allowed to converge; those that went into the banking hall were told by the Customer Service Desk to produce their NIN slips.

Those without the slips were turned back. Customers who explained their mission to the bank’s security officers before entering the banking hall were told to get the slips.

The correspondent also observed that the bank’s customers without their NIN slips were not allowed to participate in the process by the Customer Service Desk.

“We can only accept the NIN slip now,” the official insisted.

Those with NIN slips were admitted, but an angry customer who walked away said, “You cannot be treating customers this way in this era of high competition.”.

The banking hall of the Stanbic IBTC Bank was filled with customers as they were allowed in by the security operatives while others waited in queues to take their turns.

Supreme News reports that the pressure was lessened at the FirstBank Akonwonjo branch, as customers who were yet to conduct the link were asked to bring an NIN slip, a BVN, and a current passport photograph.

Supreme News reports that banks on Lagos Island also experienced the rush to meet CBN’s timelines on Thursday, but various outlets deployed different methods of handling customers.

At Access Bank, Marina, the customers were provided seats outside the banking hall and were given numbers.

One of the customers who spoke with the correspondent, Miss Azeezat Oladele, a PoS operator at Odunade Market, near Alaba International Market in Orile, said she had to endure a long wait.

“I linked my NIN to BVN long ago, but I lost my phone, and I am here to rectify the issue. I will also confirm my registration again.

“I have been here for over three hours; people are just too much today,” she said.

Another customer who simply identified himself as Jude said, “I got the link but I was not able to link the NIN to my BVN, that is why I am here.”

At United Bank for Africa (UBA) on Broad Street, customers who came for linkage were asked to do a first online registration outside before going into the banking hall.

Two bank staff used mini computers to do the first registration at the entrance before security allowed the customers into the banking hall.

At Providus Bank on Nnamdi Azikiwe Road, customers were given forms and assisted with registration simultaneously, while others waited to take their turns.

The situation was similar at Wema Bank on Broad Street and other banks visited on Lagos Island.