- Home

- /

- Business/Economy

- /

- Continuous increasing...

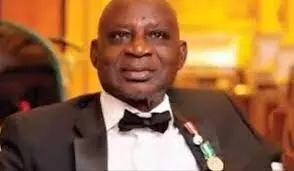

Continuous increasing of MPR will not grow Nigeria’s economy – ex-CBN director

Former Director of Research, Central Bank of Nigeria (CBN), Dr. Titus Okunrounmu, says the continuous increase in the Monetary Policy Rate (MPR) by the bank’s Monetary Policy Committee (MPC) will not help the economy grow.

Okunrounmu said this to the newsmen on Wednesday in Ota.

He spoke while reacting to CBN Gov. Olayemi Cardoso’s announcement of the increase of MPR from 22.75 percent to 24.75 percent after its two-day Monetary Policy Committee (MPC) meeting on Tuesday in Abuja.

MPR is a short-term, often overnight rate that banks charge one another to borrow funds.

Cardoso had announced the rise in a communiqué he read at the 294th meeting of the MPC.

Cardoso had also announced on Tuesday in Abuja that the MPC adjusted the asymmetric corridor to +100/-300 basis points around the MPR and retained the cash reserve ratio at 45 percent.

The former CBN director said the MPC of the apex bank was looking at the available data to make key decisions, but it was not making the economy grow because no one would be willing to borrow at a higher interest rate.

“The continuous raising of MPC is not helping the economy because everybody is crying and who wants to borrow at 25 percent?

“That is the question we should ask ourselves, apart from looking at the data, as lowering the rate would have helped the economy to grow.”

He appealed to the Federal Government to effectively use the funds borrowed from the CBN on capital projects, as they were also borrowing at a higher interest rate.

The former CBN director appealed to the government to redouble its efforts towards looking for alternative source of power supply in the country.

He said that with a stable power supply, the productive sector would be able to produce sufficient goods for both local consumption and export purposes.

He saidthis would in turn generate foreign exchange for the country and reduce pressure on currency.

Okunrounmu said it would also drastically bring down the inflation rate and stabilise the foreign exchange.